Personal budget and planning for beginners

A personal budget is a plan to help you spend your money/resources in a specific period, e.g., it can be the monthly or yearly budget plan. Though plans are not reality. Plans might need to change when the situation and reality facts vary.

I have made a few budget plans in the past, and my realities changed. I abandoned my budget plans. In my case, it was unexpected bereavements, and my budget plans had to change.

I know. I understand.

I have also seen other few trends and how budget plans can be broken. However, I have ten keys to workable budget plans for you as a beginner. Your budget will help you preserve and save money since it will help ensure you live below your total income in a specific period.

Personal budget planning is vital to your financial success. If financial freedom is your goal, I want to inform you that a goal without a plan is just a wish. So start with my ten easy keys to workable personal budget plans.

Five keys to workable budget plans for you as a beginner are as follows:

- Be intentional and truthful about your total income

Having a clear and workable budget means you must have a clear plan for overcoming promises and unexpected gifts; it also means you will have a workable budget when you work with correct income information.

Don’t add funds anyone promised to give you that you have not seen in your account.

- Make sure it is realistic with current market price information

Don’t add price value to things that can change in the shop if you have not confirmed it. You want to succeed, not to fail. This means you must be sure or leave some loose pounds for adjustments.

I used to buy a particular brand of olive oil for £18. I went to get it for my monthly stock-up and found out it added £11 to the old price. This made the new price to become £29.

- Evaluate your monthly expenses

Before dabbling into your budget planning, evaluate your past three months’ expenses for a clear spending trend. This will give you a clear picture. Get a plain sheet of paper and write down every pound and penny you pay every day from the first day of the first month to the last day of the same month. Do this in the past three months and check the difference between the three months. You can equally add three of them together and divide them by three. Take the average figure as your total monthly expenses, e.g.,

January total expenses are £890

February total expenses are £910

March total expenses are £905

____________________________

Total = 2, 705

____________________________

2,705 divided by 3 = 901.7

So £901.7 becomes the average spending limit.

It becomes the assumed spending limit and what will be used as the expected monthly expenses. Now, you have your formula for finding your spending limit.

- It must be what you need and want

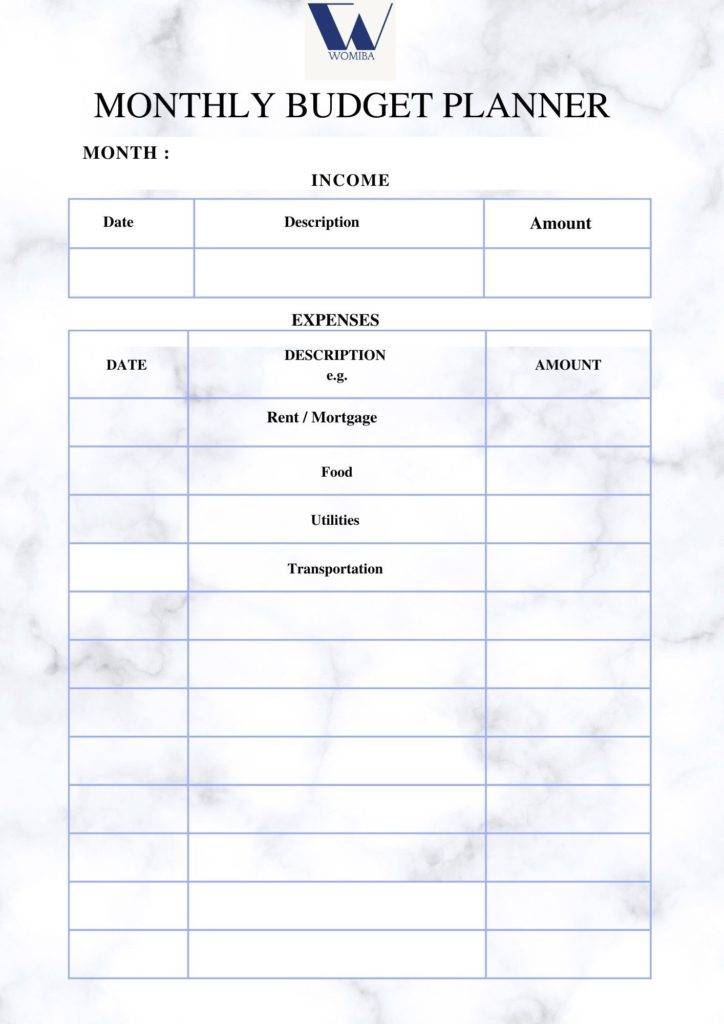

The catalyst for more success in having a workable budget plan is making it what you need and want. Download Womiba monthly budget plan attached to this post and write down all your income. Then list your monthly expenses. You already have your spending limit, which can also be called a monthly budget allocation.

To be able to save or cut back due to inflation, you must make adjustments to your monthly budget allocation limits. Check what you were spending on that is not necessary.

Do you spend money on lunch?

Can you take homemade lunch to work?

If you can, go for it and save the lunch money. This made a significant difference in my budget a long time ago.

- Time to control your money

Now on a Womiba monthly budget planner, write down what you need in the descriptions of expenses section. I have written the basics, and you can add all your personal monthly needs and want. Add the dates you are due to pay most electricity or mortgage. Enter the amount of each line in the description.

Hurray!

You have a budget.

I hope this assists you in starting your budget.

Please let me know your feelings about this blog post in the comment section.

Thank you

Hello there! I simply want to offer you a huge thumbs up for your excellent information you have here on this post. I will be coming back to your website for more soon.

Thank you for reading my blog. I am glad you liked it.

Very insightful, though I have been doing this but really love what I read thru here

Beautiful, thank you for dropping by, have a great day.

A very insightful piece. Thanks for sharing

Thank you for reading our blog.